Islamabad High Court (IHC) has directed Jazz to deposit Rs. 5 billion to the Federal Board of Revenue (FBR), which… Read More

The post Islamabad High Court Issues Adhoc Order on Jazz vs FBR Case appeared first on .

Islamabad High Court (IHC) has directed Jazz to deposit Rs. 5 billion to the Federal Board of Revenue (FBR), which would be conditional in nature and maybe returned to Jazz or adjusted if case is decided in favor of Jazz.

According to the official order by the court, out of total Rs.25 billion in alleged tax liability, IHC has directed the company to deposit Rs. 5 billion tax within the next three days.

Subject to conditional payment of Rs. 5 Billion, IHC dismissed the notices issued to Jazz by FBR.

Next hearing on the case is set for December 2nd, 2020.

Rs. 25 billion tax liability included the principal amount of due tax and the penalty and default surcharge.

The company has informed the court that they are ready to deposit a tax of Rs. 5 billion to the FBR.

Talking to ProPakistani, senior FBR officials informed that in the past Large Taxpayer Office (LTO), Islamabad had rejected the company’s similar offer of advance payment of Rs. 5 billion saying that amount was meager as compared to total liability.

Federal Board of Revenue had sealed the head office of Jazz in Islamabad, allegedly for non-payment of Rs. 25 billion in taxes, which was later unsealed after an order from the Islamabad High Court.

Update:

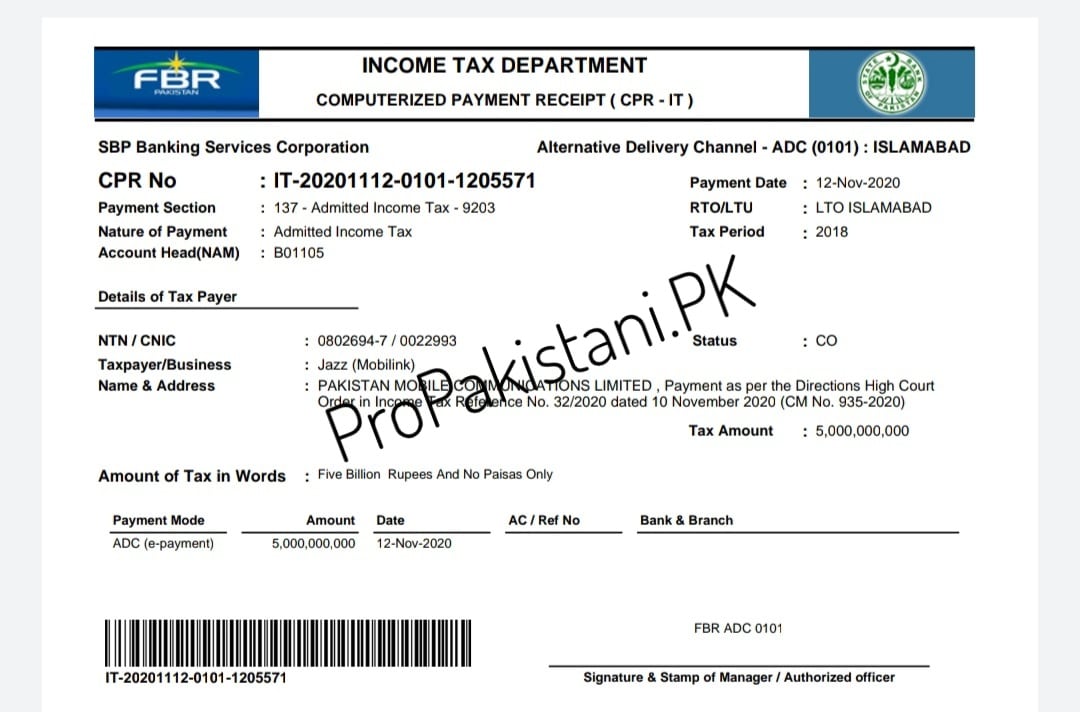

Our sources at FBR just confirmed that Jazz has deposited the Rs. 5 Billion as conditional tax, as protest that it plans to challenge.

Below is the transaction receipt:

The post Islamabad High Court Issues Adhoc Order on Jazz vs FBR Case appeared first on .

12/11/2020 03:09 PM

12/11/2020 12:30 PM

12/11/2020 12:51 PM

12/11/2020 01:55 PM

12/11/2020 05:38 AM

12/11/2020 06:27 AM

12/11/2020 01:10 PM

2014 © Pakistani apps and news