The Credit Rating agency, Moody’s, has stated that Islamic banking in Pakistan has a substantial growth potential as around 80… Read More

The post Islamic Banking is Boosting Profitability for Pakistani Banks: Moody’s appeared first on .

The Credit Rating agency, Moody’s, has stated that Islamic banking in Pakistan has a substantial growth potential as around 80 percent of the country’s population remains unbanked in the Muslim majority economy.

The report stated that with Pakistan’s Muslim population reaching more than 96 percent of the country’s total population and 79 percent of the population remaining unbanked, according to World Bank data, the potential for Islamic banking penetration is substantial.

”As Islamic banking institutions attract more shariah-compliant deposits, they will benefit from stronger profitability. Islamic banking products are attracting previously unbanked customers, creating new business opportunities for banks to grow their deposit base.” Moody’s Investors Service said in a report.

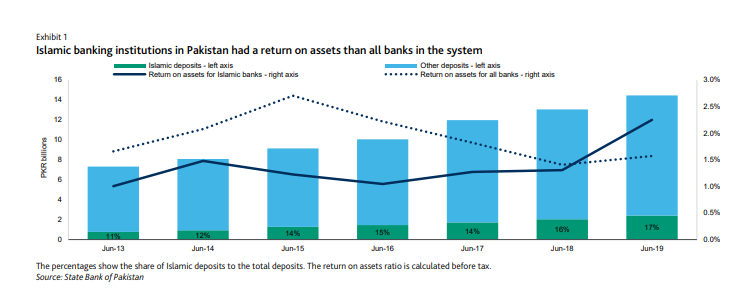

Moody’s said that Islamic deposits have grown 21 percent on a compound annual basis for the six-year period through June 2019, outpacing the 11 percent compound annual growth rate of all other deposit types.

“In addition, Islamic deposits do not earn interest under shariah law, thereby reducing interest expense and generating higher margins and profitability,” it said. “Additionally, the bulk of these deposits are low-cost, non-remunerated, shariah-compliant that will boost banks’ interest income and margins.”

The return on assets for Islamic banking institutions was 2.3 percent at the end of June 2019 versus an average of 1.6 percent for all banks in the system said the report.

“As part of the national strategy to increase financial inclusion, the Pakistani government is focusing on a series of initiatives targeting the growth of the Islamic finance industry,” the report added.

These initiatives include the adoption of global reporting standards and the introduction of a shariah-compliant regulatory framework, such as easing initial capital requirements for Islamic banking subsidiaries, facilitating conversion into Islamic mode, introducing tax neutrality for shariah-compliant banking and crafting exceptions for using the Karachi Interbank Offered Rate as a benchmark for pricing financing.

“In addition, the government is further supporting the growth of Islamic finance through regular sukuk issuances,” Moody’s said. All five Pakistani banks Moody’s rates offer Islamic products via either subsidiary banks or Islamic windows, and “increased Islamic banking penetration is credit positive because it will support their profitability”.

The Securities and Exchange Commission of Pakistan is also working towards enhancing liquidity management with the creation of an open market and auction platform for sovereign Sukuk offerings.

A significant portion of Islamic banking customers come from populations that were previously unbanked, thus creating a new revenue source for banks, said the report. Additionally, the bulk of these deposits are low-cost, non-remunerated, Shariah-compliant that will boost banks’ interest income and margins.

The State Bank of Pakistan set a goal to increase Islamic assets to 20% of the market, with a focus on lifting structural and regulatory barriers and increasing awareness. In addition, the government is further supporting the growth of Islamic finance in Pakistan through regular Sukuk issuances.

As of June 2019, there were five fully-fledged Islamic banks in Pakistan,

The post Islamic Banking is Boosting Profitability for Pakistani Banks: Moody’s appeared first on .

20/09/2019 12:27 PM

20/09/2019 01:17 PM

20/09/2019 12:54 PM

20/09/2019 01:57 PM

20/09/2019 02:21 PM

20/09/2019 02:00 PM

20/09/2019 06:19 AM

20/09/2019 12:57 PM

20/09/2019 12:37 PM

2014 © Pakistani apps and news