According to a report by the Institute of Energy Economics and Financial Analysis (IEEFA), Pakistan is faced with the increasing… Read More

The post New Coal Power Plants Are Increasing Pakistan’s Circular Debt: IEEFA Report appeared first on .

According to a report by the Institute of Energy Economics and Financial Analysis (IEEFA), Pakistan is faced with the increasing financial burden of power capacity payments and overcapacity risk at a time when renewables are the cheapest source of energy available. Even before the COVID-19 pandemic, Pakistan’s electricity demand was decreasing.

Two more Chinese-financed coal-fired plants have reached financial close so far in 2020, with more in more in the pipeline intended to meet the overestimated demand growth projections.

Report author Simon Nicholas at the IEEFA says the government needs to urgently rebalance proposed new energy builds against a changing power demand growth outlook post-COVID-19 lockdown.

High capacity payments to thermal and coal-power generators, coupled with surplus installed generation capacity, had been adding to the increasing cost of electricity and worsening circular debt, he said.

According to the data of the National Electric Power Regulatory Authority (NEPRA), thermal power capacity utilization was just 40% in the 2018-19 financial year. The capacity payments are still to be made to the power plants, even when the plants were not functional during the pandemic due to lower-than-expected power demand growth.

“The government of Pakistan has now asked China for easier repayment terms on 12 GW of CPEC (China-Pakistan Economic Corridor) power projects, with a total investment of $30 billion,” he said.

Power shortages in Pakistan tend to be due to grid issues rather than a lack of generation capacity. Instead of addressing transmission and distribution issues, the government plans to continue rolling out large coal-fired stations with significant capacity payments due, according to their agreed tariff.

Electricity is getting more expensive due to high unsustainability and growing capacity payments. This is contributing towards the increasing circular debt which is now at around Rs. 2 trillion ($12 billion).

“Pakistan faces the prospect of further power system debt to just one nation if it continues its plan to exploit Thar coal reserves,” says Nicholas. Chinese finance is increasingly becoming the only funding source available for coal power, more than 130 financial institutions around the world are turning towards a cheaper, sustainable, renewable, and alternating energy source.

Nicholas added that a switch in focus from coal to renewables would be more worth-while for Pakistan, as it would attract diverse sources of power finance and investment while reducing debt reliance on a single nation.

In addition to being the cheapest source of new power generation in Pakistan, renewable energy also has the advantage of being able to attract a wider range of potential investors to Pakistan who now does not want to invest in coal.

Nicholas modeled power demand growth going forward for the country as a whole – with a focus on renewable energy leader Sindh province.

Sindh has the potential to pave the way for the country to steer out of the financial crisis in the power sector by building renewable energy projects like wind and solar.

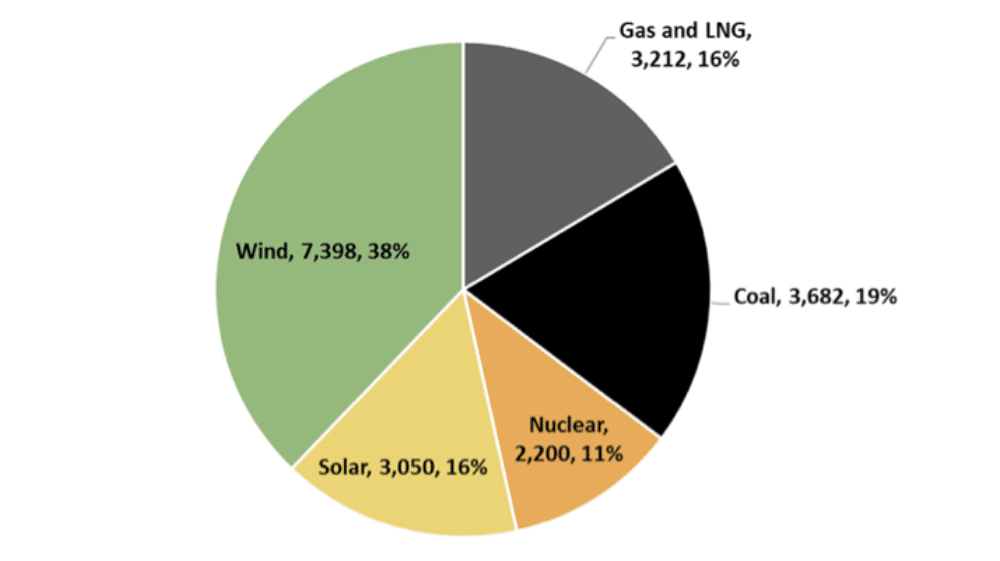

Source – NEPRA, IEEFA Calculations

Source – NEPRA, IEEFA Calculations According to IEEFA’s model, by 2030 Sindh could reach more than 50% renewable energy capacity, leading Pakistan in meeting its national renewables target. While not as ambitious as IEEFA’s modeling, Nicholas notes the government’s new draft energy policy represents a significant step forward for increased renewable energy ambition in Pakistan.

He concluded,

Instead of locking in long-term, expensive overcapacity, Pakistan’s post-pandemic economic growth, and prosperity will be better enabled by further reliance on ever-cheaper wind and solar than on fossil fuel-based plants dependent on large loans that are required to be repaid quickly.

The post New Coal Power Plants Are Increasing Pakistan’s Circular Debt: IEEFA Report appeared first on .

27/06/2020 09:50 AM

27/06/2020 09:22 AM

27/06/2020 10:34 AM

27/06/2020 11:18 AM

27/06/2020 05:55 AM

27/06/2020 03:15 PM

27/06/2020 06:59 AM

2014 © Pakistani apps and news