In developing countries like Pakistan, slow digital uptake has been a burning issue, particularly with respect to banking. Opening a… Read More

The post Self Serve Kiosks Are Helping Boost Financial Inclusion in Pakistan appeared first on .

In developing countries like Pakistan, slow digital uptake has been a burning issue, particularly with respect to banking.

Opening a bank account is a time-consuming process that involves physically going to a bank branch and filling out documentation. It also takes weeks for the checkbooks and debit cards to arrive.

Mobile wallets like Easypaisa and Jazzcash have bridged the gap and accelerate financial inclusion. Pakistan has over 46 million mobile wallets and people use them to send and receive payments, pay utility bills, and avail a number of services.

The rise of mobile wallets has also led to an interesting shift towards self-serve kiosks, which provide the same services for the most part, but critically for rural areas as well as tier 2+ cities, allow people to deposit or withdraw cash from their accounts. A lot of Pakistan still doesn’t have access to banking infrastructure, and these kiosks address that pain point by providing an easy way of converting hard cash into digital currency.

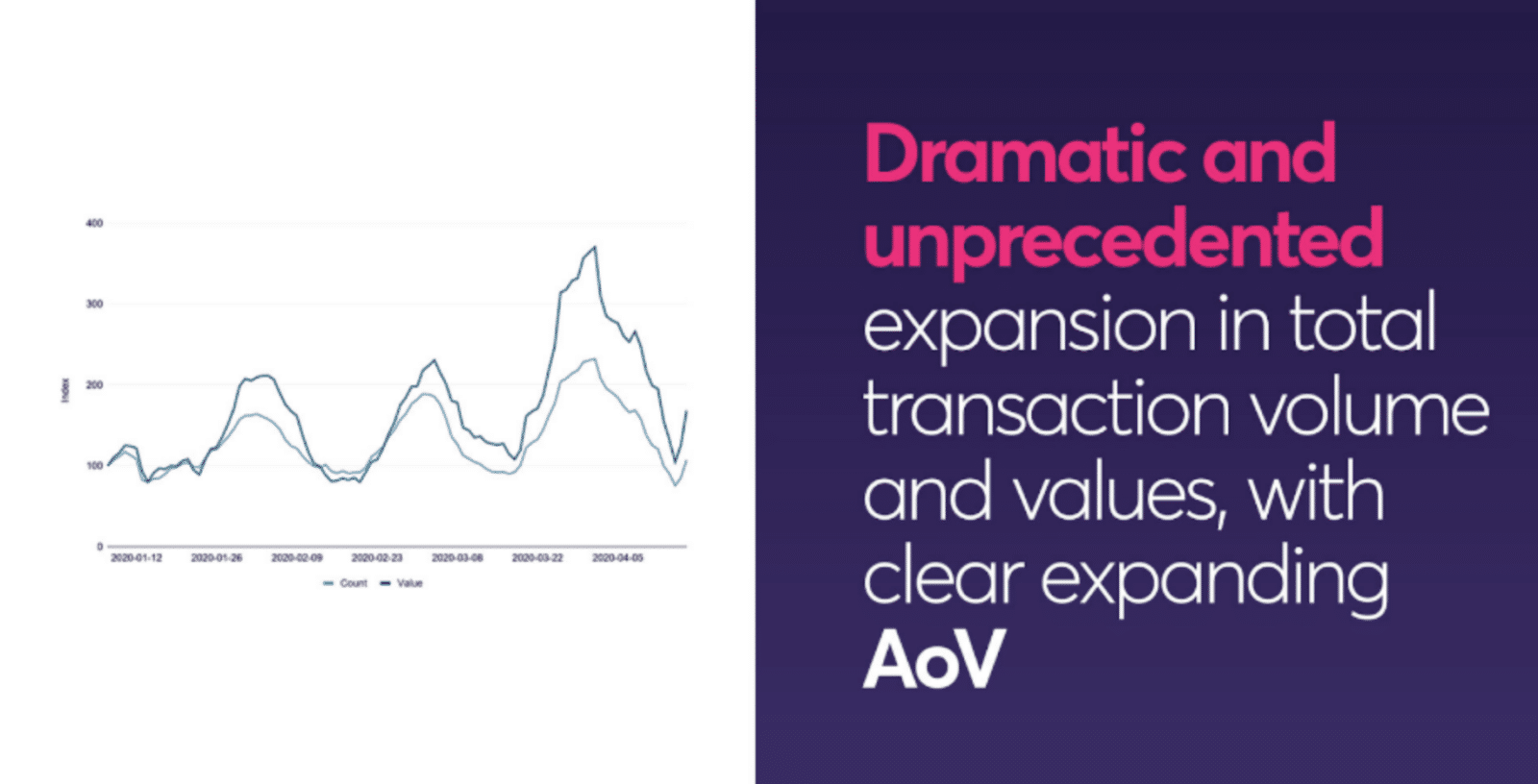

With the COVID-19 pandemic forcing bank branch closures and many of them to operate on reduced hours, online banking, mobile wallets and self-serve kiosks have seen an unprecedented surge in usage, transaction volume, and value.

Self-service kiosk solutions are providing Pakistanis an alternative channel to branches, which have a high risk of contagion. In comparison, machines allow customers to carry out transactions without human intervention and contact, making them ideal for the post-COVID world.

A lot of the self-service machines we see and interact within Pakistan are from Azimut, a leading designer and manufacturer of banking, mobile banking, and telecom self-service solutions. Azimut is part of the Wavetec Group, a 20-year-old global enterprise.

For Pakistan, it has localized its technology to meet the unique challenges of the country’s environment – soiled currency, unpredictable power, connectivity, and difficult operating conditions.

Companies like Azimut, in collaboration with their banking and telecom partners, are doing their part to narrow these gaps that remain a major hindrance in Pakistan’s progress toward a digital future.

By adopting a design thinking led approach, Azimut ensures even first time users can easily carry out even the most complex banking transactions on their own. The user experience is simplified with instructions in English, Urdu and even voice guidance.

Getting in touch with customer service is as simple as picking up the phone attached to the kiosk. Some next-gen machines are even equipped with the ability to video call agents for instant and real-time guidance.

According to Naushervan Beg, SVP Banking & Telecom Solutions at Azimut,

In terms of numbers, we are currently at more than 300 active deployments across the country, and have production and installation underway to be at 500+ active machines by the end of the third quarter. We are helping big organizations drive securely into the digital era and connect more deeply with their consumers by delivering an omnichannel experience.

This, we believe, is the only network of its nature in Pakistan and one of the larger ones in the region.

Whether it is to ease lives or empower the underprivileged or the disadvantaged, digitalization of the local financial services landscape is indispensable. The current pandemic has also made it clear that urgent steps must be taken to close the huge financial inclusion divide that exists in Pakistan even today.

Data via Azimut, Covid 19 Impact on Self Service, Early Empirical Analysis.

The post Self Serve Kiosks Are Helping Boost Financial Inclusion in Pakistan appeared first on .

18/06/2020 12:45 PM

18/06/2020 05:47 AM

18/06/2020 01:13 PM

18/06/2020 12:47 PM

18/06/2020 12:33 PM

18/06/2020 12:14 PM

18/06/2020 01:26 PM

2014 © Pakistani apps and news