The Federal Board of Revenue (FBR) has issued an official report on tax expenditure for 2019-2020, which mentions a list… Read More

The post FBR’s Latest Report Shows Tax Exemptions Given to Judges, Civilians & The Military appeared first on .

The Federal Board of Revenue (FBR) has issued an official report on tax expenditure for 2019-2020, which mentions a list of departments that availed exemptions from total income.

The report shows that income tax exemptions and concessions worth billions were given to the top government officials, judges of superior courts, and military officers on perks and privileges in the tax year 2019.

Tax expenditure is a term that refers to the amount of revenue the state foregoes when it grants a tax exemption or a concession.

According to FBR, the cost of exemptions on house rent allowance to judges of the Supreme Court or High Courts is estimated at Rs. 31.79 million.

The total cost of exemption on perquisites, benefits, and allowances received by judges of the Supreme Court of Pakistan and High Court is estimated at Rs. 282.95 million.

The total number of in-service judges is 130 and the number of retired judges is 390. The total house rent allowance paid to judges in the tax year 2019 was Rs. 127.17 million. The tax expenditure is calculated at the rate of 25%.

The total superior judicial allowance as reported by AGs stood at Rs. 526.50 million for in-service judges. While the total value of perquisites for in-service and retired judges is Rs. 605.28 million.

The former allowance is exclusively for 130 in-service judges while the second one is for both in-service and 390 retired judges. The exemption cost is estimated at Rs. 2 million on the fee of rent residence for President of Pakistan, Governors, and the Chiefs of Staff of Pakistan Armed Forces.

Allowances received by pilots of any Pakistani airlines are taxed at a rate of 7.5%. The cost of concession in rates on allowance to pilots of any Pakistani airlines is estimated at Rs. 430 million.

The cost of lower rates on flying and submarine allowance is estimated at Rs. 133 million. The exemption cost is estimated at Rs. 84 million on income received by dependents and families of Shuhada.

The cost of different allowances paid to armed forces personnel is estimated at Rs 1.10 billion, said the report.

The report did not mention the cost of free conveyance and sumptuary (entertainment) allowances given to Chiefs of Staff of Pakistan Armed Forces and corps commanders. The cost of foreign allowances to employees (diplomats) is estimated at Rs 1.167 billion

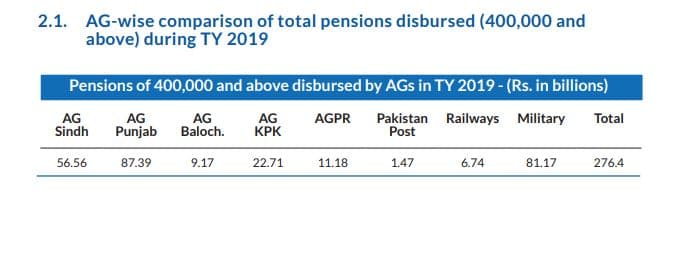

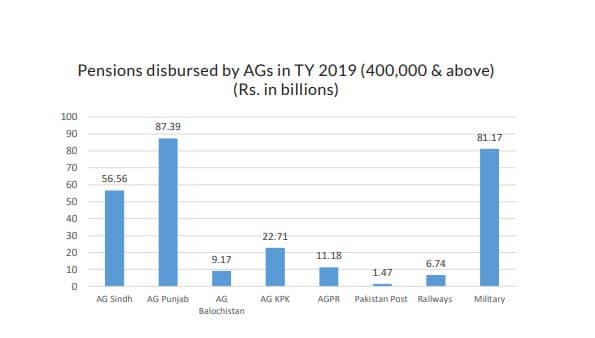

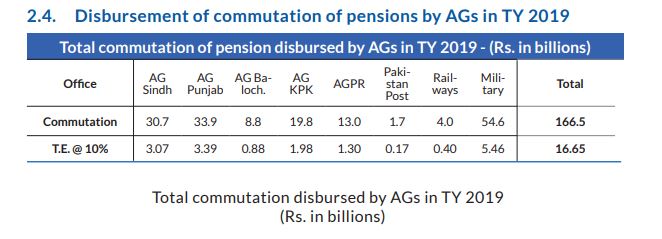

As the pension and commutation of pension are exempted from income tax, the report used pension data maintained by four provincial and federal accountants general and separate AGs for Pakistan Railways, Pakistan Post, and Military.

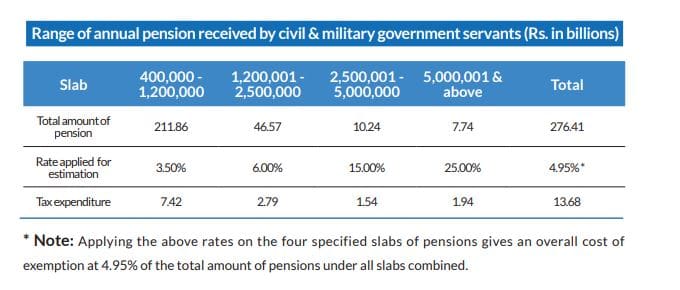

The exemption cost is estimated for the pension over and above the exemption threshold of Rs. 400,000.

Pensions received by employees of the Federal Government, Provincial Government, or Armed Forces, or their families and dependents are estimated Rs. 13.68 billion.

The total amount of pension paid in the tax year 2019 stands at Rs. 276.4 billion across Pakistan.

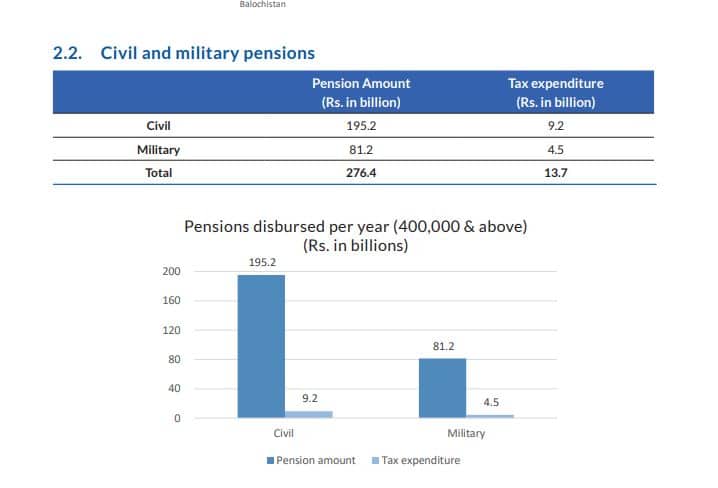

These figures include pensions whose amount is above Rs. 400,000 per annum. The tax exemption cost calculated on civilian pension stands at Rs. 9.2 billion and on military pension at Rs. 4.5 billion.

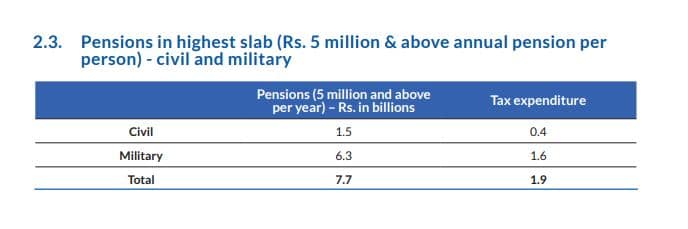

For the persons receiving pensions above Rs. 5 million per annum, (more than Rs. 400,000 per month) the proportion between civilians and the military is the opposite. The total amount paid in this slab to military personnel stood at Rs. 6.3 billion, while the pension payments to all civilian officers, including judges of superior courts and federal secretaries, stood at Rs. 1.5 billion.

The report does not mention the number of beneficiaries or rank wise comparison.

The tax concessions on the payment of commutation pension were estimated at Rs. 16.65 billion in the tax year 2019.

The post FBR’s Latest Report Shows Tax Exemptions Given to Judges, Civilians & The Military appeared first on .

27/06/2020 01:10 PM

27/06/2020 06:59 AM

27/06/2020 09:22 AM

27/06/2020 05:55 AM

27/06/2020 09:50 AM

27/06/2020 11:18 AM

27/06/2020 11:56 AM

27/06/2020 03:15 PM

2014 © Pakistani apps and news