Investors in Pakistan are switching out of stocks and are converting their positions into fixed income which is offering double-digit… Read More

The post Pakistan’s Investors Are Ignoring Equities for High Return on Debt: Bloomberg appeared first on .

Investors in Pakistan are switching out of stocks and are converting their positions into fixed income which is offering double-digit returns.

Bloomberg reported that earning more than 13% from debt is proving too hard to pass up on with the nation’s equity market refusing to show signs of life after being in the doldrums for more than two years.

The central bank’s efforts to curb inflation and stabilize its currency by raising borrowing costs will keep fixed-income attractive for longer, analysts say.

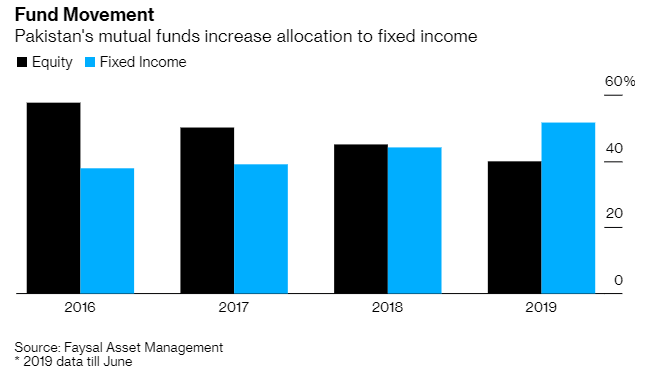

“The outlook for growth and earnings is not there” for equities to perform, The only area where you will make money is fixed income.” Ayub Khuhro, Chief Investment Officer at Faysal Asset Management Ltd., said in an interview with Bloomberg.

The benchmark equity index (KSE-100) has dropped 41% since rallying to a record high in May 2017 as Pakistan’s return to emerging-market status sparked outflows instead of the expected inflows.

The report states that debt securities have become attractive after the central bank more than doubled its policy rate to 13.25%, which is the highest in Asia.

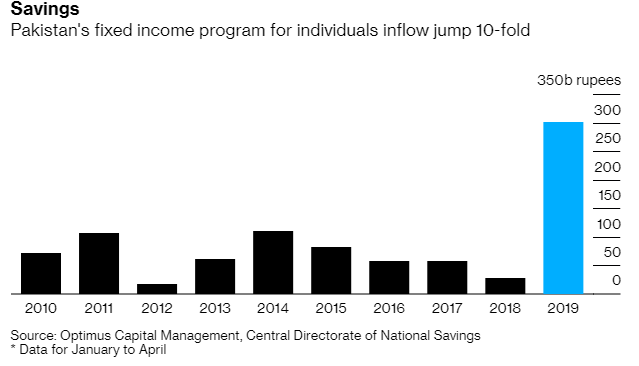

Pakistan’s mutual fund industry held 52% of its 540 billion rupees of assets in debt, up from 31% two years ago. Inflows into the state-owned fixed income plan for individuals, whose returns are linked to the central bank’s policy rate, jumped 10-fold in a four-month period ending on April 2018, according to the most recent data.

Meanwhile, the average traded volume in members of the KSE-100 equity index dropped 62% in July from a year earlier.

“Why would I go into equity when I can invest at rates as high as 14.25%,” said Khuhro. “Equity should be looked at around December next year.”

Interest rate works as gravity for the equities. The higher it is, the harder it pulls the exchange down. That’s one of the reasons why the market is plummeting, the interest rate is at 13.25% and because of that most people are currently parking their savings in government papers, as yields on PIBs have been on the rise.

Yields on 3 and 10-year treasury papers are so good that fresh investment flows cannot be expected in the equities market.

The benchmark index has produced phenomenal gains in the long run. There are no sure answers about the market’s behavior for the next 12 months but that’s a situation that separates the men from the boys.

This is all hindsight as it is impossible to time the market perfectly each time as nobody knows where the exact bottom or top is.

You have to be in it, to win it.

Via Bloomberg

The post Pakistan’s Investors Are Ignoring Equities for High Return on Debt: Bloomberg appeared first on .

08/08/2019 12:21 PM

08/08/2019 05:40 AM

08/08/2019 11:44 AM

08/08/2019 06:01 PM

08/08/2019 01:26 PM

08/08/2019 01:50 PM

08/08/2019 11:47 AM

2014 © Pakistani apps and news